Services In UAE

Services In UAE

Pravega Global Service, your partner for Business setup consultants and support in the UAE, understands that establishing a business in this dynamic region is not just about securing the right structure and license. It encompasses a wide range of crucial factors, such as selecting suitable office spaces or warehouses, forging the right partnerships, connecting with clients or investors, and building a skilled workforce, among others.

Based on your business requirements, you can choose the most suitable jurisdiction for your business specific needs.–Free Zone, Mainland, or Offshore. Each of these options has its own advantages and limitations, offering diverse opportunities that cater to various entrepreneurial priorities. Let's delve into a comparison of these jurisdiction options to help you choose the best fit for your company.

Pravega Global Service provides personalized guidance to ensure that your business setup in the UAE meets your objectives while complying with local regulations. We offer tailor-made business consulting services to global companies, assisting them in setting up their businesses while optimizing their fiscal structures. Additionally, we conduct in-depth market research to provide you with valuable insights.

Our team at the company incorporation consultant in UAE is dedicated to guiding global investors through the process of starting and successfully operating a company in the UAE. We specialize in all types of company registrations, from offshore entities to Mainland and Free Zone businesses. Our commitment lies in delivering customized, reliable, and hassle-free solutions to fulfil all your business requirements. With a deep understanding of your unique needs and an unwavering attention to detail, our company formation consultant at Pravega is an invaluable asset to your business venture.

We are well-versed in the intricacies of the UAE business landscape, including potential challenges and obstacles you might encounter while establishing your company. More importantly, we possess the expertise to help you navigate these challenges and avoid potential pitfalls.

Your journey to success begins here with Pravega Global Service; the most trusted trusted firm registration consultant in UAE, who are dedicated to turning your dreams into reality!

Please feel free to send us an inquiry to initiate a discussion regarding your business plan, activities, and the appropriate jurisdiction for your company.

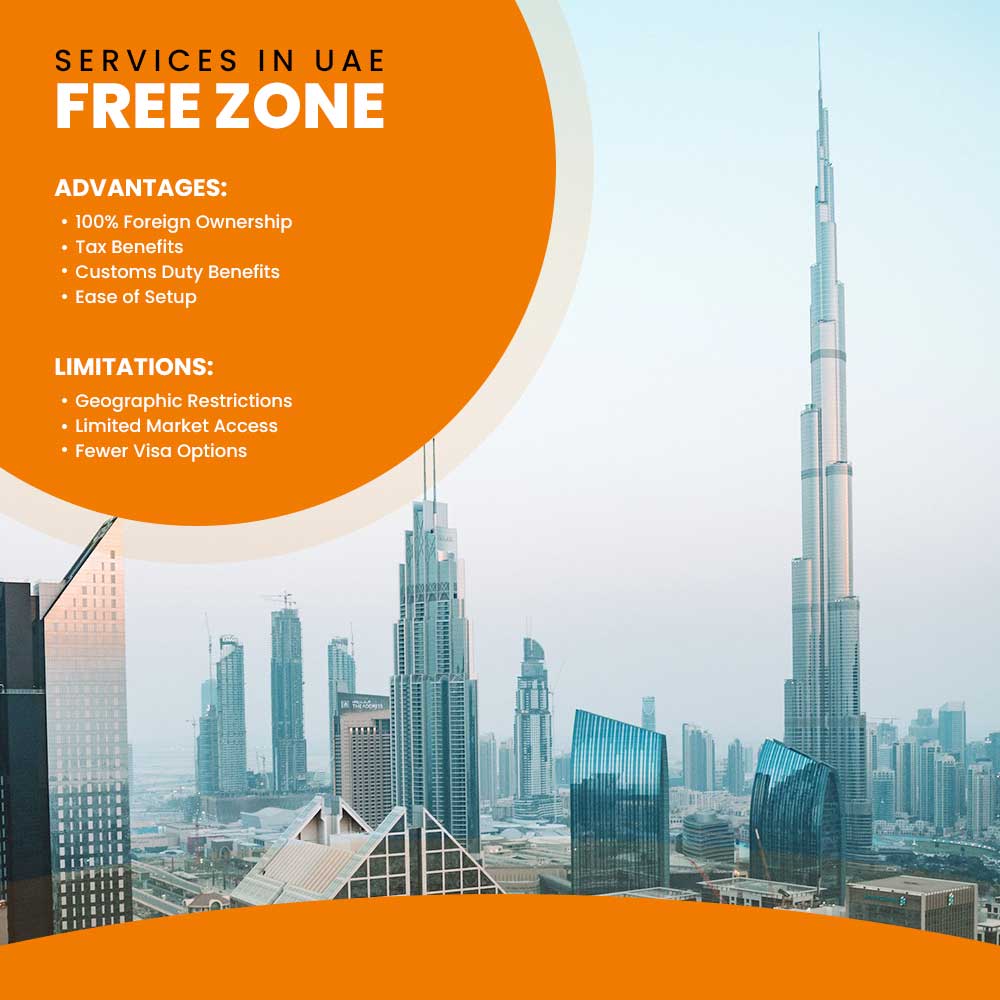

Free Zone:-

Advantages:

100% Foreign Ownership: You can have full ownership of your company without the need for a local partner or sponsor.

Tax Benefits: Many Free Zones offer tax exemptions or reduced tax rates for a specified period, often up to 15-50 years.

Customs Duty Benefits: Goods imported into Free Zones are typically exempt from customs duties.

Ease of Setup: Streamlined registration processes and minimal bureaucratic red tape with corporate tax consultants in UAE.

Limitations:

Geographic Restrictions: Free Zone businesses are often limited to operating within the respective Free Zone and may have restrictions on mainland trading.

Limited Market Access: You may have restrictions on selling products or services directly to the UAE mainland market.

Fewer Visa Options: Some Free Zones may have limitations on the number of visas you can obtain.

Mainland:-

Advantages:

Access to UAE Market: Mainland businesses can operate throughout the UAE, including selling products and services directly to the local market.

No Capital Requirements: Some mainland jurisdictions do not require a minimum share capital

Flexible Office Space: More choices in terms of office locations.

Limitations:

Local Partner/Sponsor: Mainland companies typically require a local Emirati partner or sponsor who holds a minimum equity stake (usually 51%).

License Costs: The cost of licenses and compliance can be higher in the mainland.

Regulatory Compliance: Mainland businesses must adhere to UAE labor and immigration laws, which can be more complex without Professional tax consultants.

Offshore:-

Advantages:

Asset Protection: Offshore companies are often used for holding assets, intellectual property, and international business activities.

Tax Efficiency: They may offer tax advantages for international businesses.

No Local Presence Required: No physical office or presence in the UAE is necessary.

Limitations:

No Local Business Operations: Offshore companies are typically not allowed to engage in business within the UAE. They are primarily for holding and investment activities.

Limited to Certain Activities: They are restricted from certain activities within the UAE.

Contact us to start your journey towards business success. We are here to assist you in making informed decisions and guiding you through the process of establishing and operating your business in the UAE.

Frequently Asked Questions

Pravega Business Consultants provides end-to-end business support services in the UAE, including company formation, mainland and free zone setup, trade licensing, visa assistance, banking support, compliance management, and advisory services. Their solutions are designed to simplify entry and growth for businesses in the UAE market.

Yes, Pravega Business Consultants specialises in firm registration consultant in UAE across mainland, free zone, and offshore jurisdictions. They guide clients through legal structures, documentation, licensing, and approvals, ensuring a smooth and compliant setup process while saving time and avoiding costly errors.

Absolutely. We offer comprehensive visa and PRO services, including investor visas, employment visas, family visas, Emirates ID processing, and government liaison. Their expert handling of documentation and approvals ensures faster processing and reduced administrative burden for businesses and individuals.

We assist with corporate bank account opening by coordinating with leading UAE banks and preparing the required documentation. They also support ongoing compliance, renewals, and regulatory requirements, helping businesses operate smoothly while meeting UAE legal and financial standards.

Pravega Business Consultants combines local expertise, transparent processes, and personalised guidance to deliver reliable UAE business solutions. Their client-focused approach, strong regulatory knowledge, and end-to-end support make them a trusted partner for entrepreneurs and companies looking to establish or expand in the UAE.